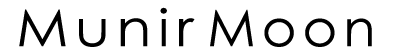

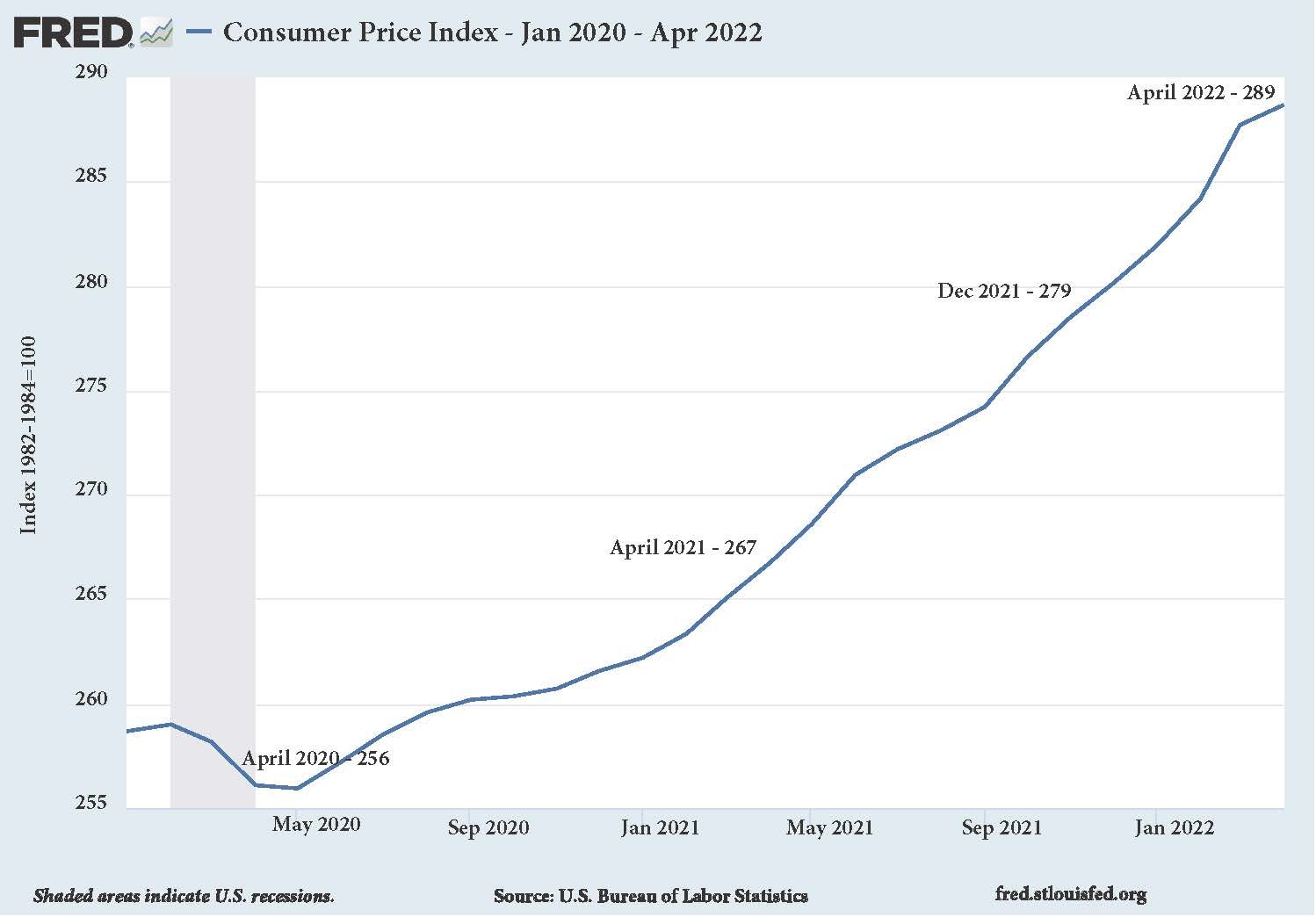

Fig.1 – Consumer Price Index – Federal Reserve of St.Louis

May 30, 2022 – In March 2020, Federal Reserve Chairman Jerome Powell (Fed Chair Powell) was concerned that Inflation was not hitting the target of 2%, but falling further. Well, his wish finally came true. Inflation in April 2022 was at 8.3% (Fig.1), the highest in the last 40 years and well above the Fed’s target. However, the Federal Reserve with J. Powell as its chairman, continued to print money and kept interest rates (Fed Funds) to almost zero. The Federal Reserve (Fed) serves as the central bank of the United States and is an independent government agency. For over a year, some Economists have been saying that the Fed is behind the curve, implying that it has been late in raising interest rates to curb inflation.

The Federal Reserve (Fed) is following the same playbook as other political entities in Washington DC. The playbook is very simple: First, to deny that there is a crisis, then acknowledge its existence once it is obvious. This follows up with the narrative that the crisis is temporary and everything is under control. Finally, there is the reaction to fix the crisis once it becomes acute and there is no way of denying its severity. Reaction starts slowly, drip by drip, hoping that the crisis will be contained. When it is too late to control the crisis then they react aggressively and take a victory lap once it is contained. (more…)

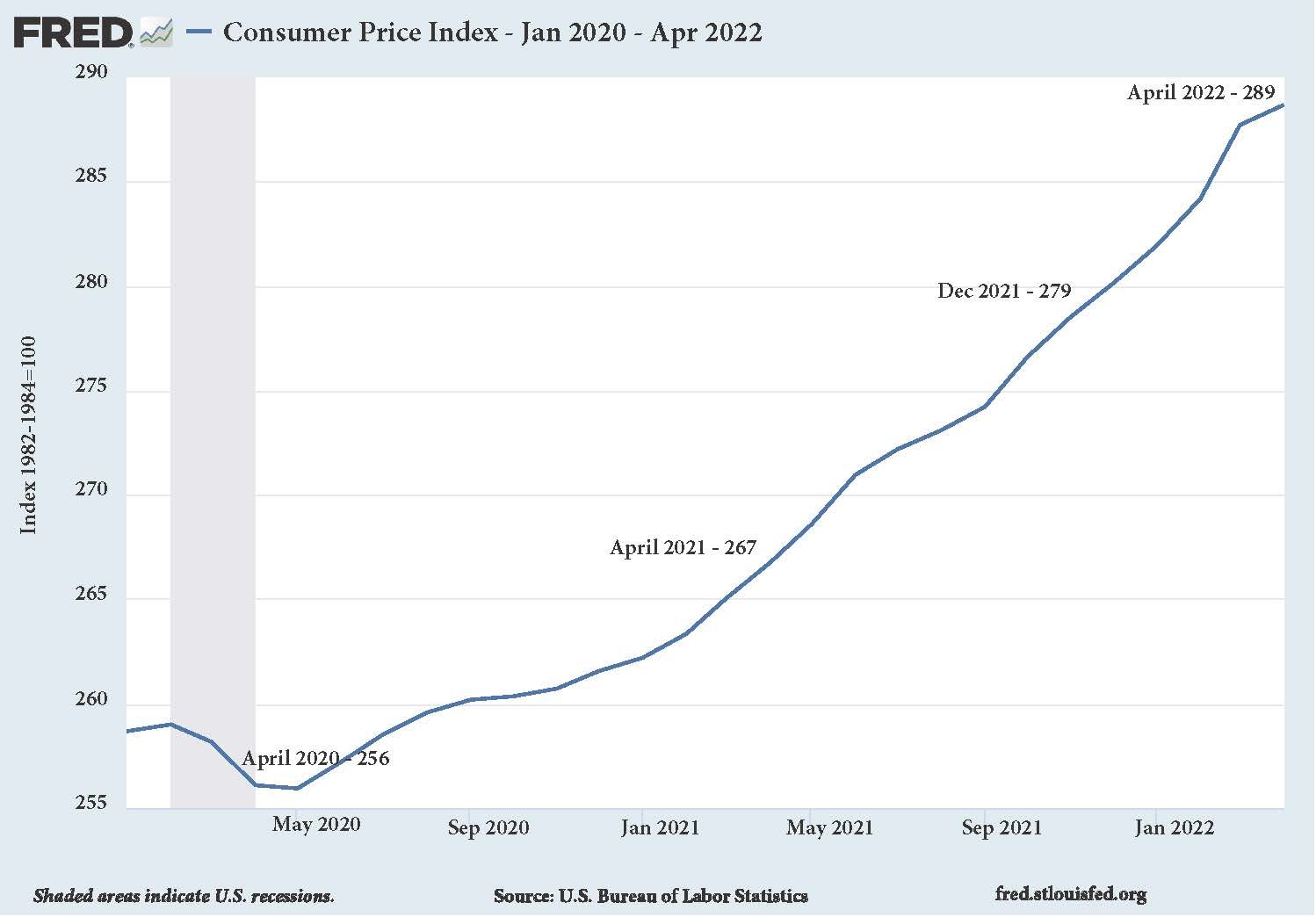

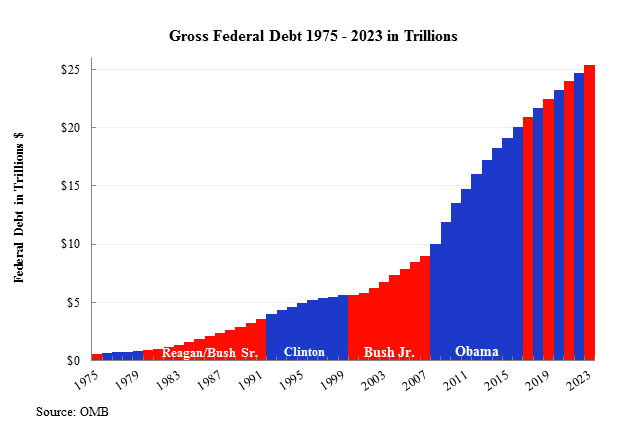

We are witnessing a grand, inter-generational Ponzi scheme that’s destined to drown our children and grandchildren in red ink. Our leaders like to call their strategy borrowing, but it is really tantamount to stealing—from our children, worse yet. Why? Because we have no plans to pay the debt. The real irony is that while civilian leaders from both parties insist that our national debt is not an immediate problem, a military man, former chairman of the Joint Chiefs of Staff Admiral Mike Mullen, has made the point that the debt is actually a national security threat. In a speech to business executives in September 2011, Mullen declared, “I’ve said many times that I believe the single, biggest threat to our national security is our debt.”

The Beltway Beast continues to borrow just to make interest payments that are estimated to be $5 trillion over the next decade. All the while we are doing nothing to pay down the staggering U.S. debt that is projected to reach $25 trillion by 2020 according to the Federal Budget Outlook of 2013 and 2014. Add to that $1 trillion in student loans and the result is a significant amount of money taken out of the economy that could be invested in creating jobs at home.

Equally alarming, perhaps even surreal, is that party leaders who can hardly agree on the color of the White House can be found nodding their approval at the fiscal fiction “that deficits don’t matter,” as then-Vice President Dick Cheney told a disbelieving Paul O’Neill, the treasury secretary in George W. Bush’s first term. That was over 10 years ago. Fast forward to President Obama, who told George Stephanopoulos in March 2013 that “we don’t have an immediate crisis in terms of debt. In fact, for the next 10 years, it’s [the deficit] gonna be in a sustainable place.” House Speaker John Boehner agrees that there is no immediate debt crisis. Neither one of them want to tell us who will pay the mounting U.S. debt.

September 8, 2014 – Something that Washington does not want you to know about and hopes that nobody else will discuss during the minimum-wage debate is take-home pay after taxes for low-wage earners. Washington claims that Americans should be paid living wages so that they can live a decent life. However, it is not willing to give up its share of the booty that it would collect from the same low-wage earners it claims to help.

For example, the federal government will collect at least 15 percent of the increased income from those low-wage earners through payroll tax. In other words, if the minimum wage goes up by a dollar, the federal government will take away, directly or indirectly, at least 15 cents of that additional dollar from the working poor.

Asking large corporations, which are in business to make money, to pay additional wages is like asking them to be saints. Government mandates do not have a major impact on large corporations, since they will figure out a way around them. After all, they can rent lawmakers; one former senator famously declared, “My vote can’t be bought, but it can be rented.” On the other hand, politicians do not pay anything from their pockets either. They will just give the money to one group and take it from another, but not from the special-interest groups that finance their campaigns. (more…)