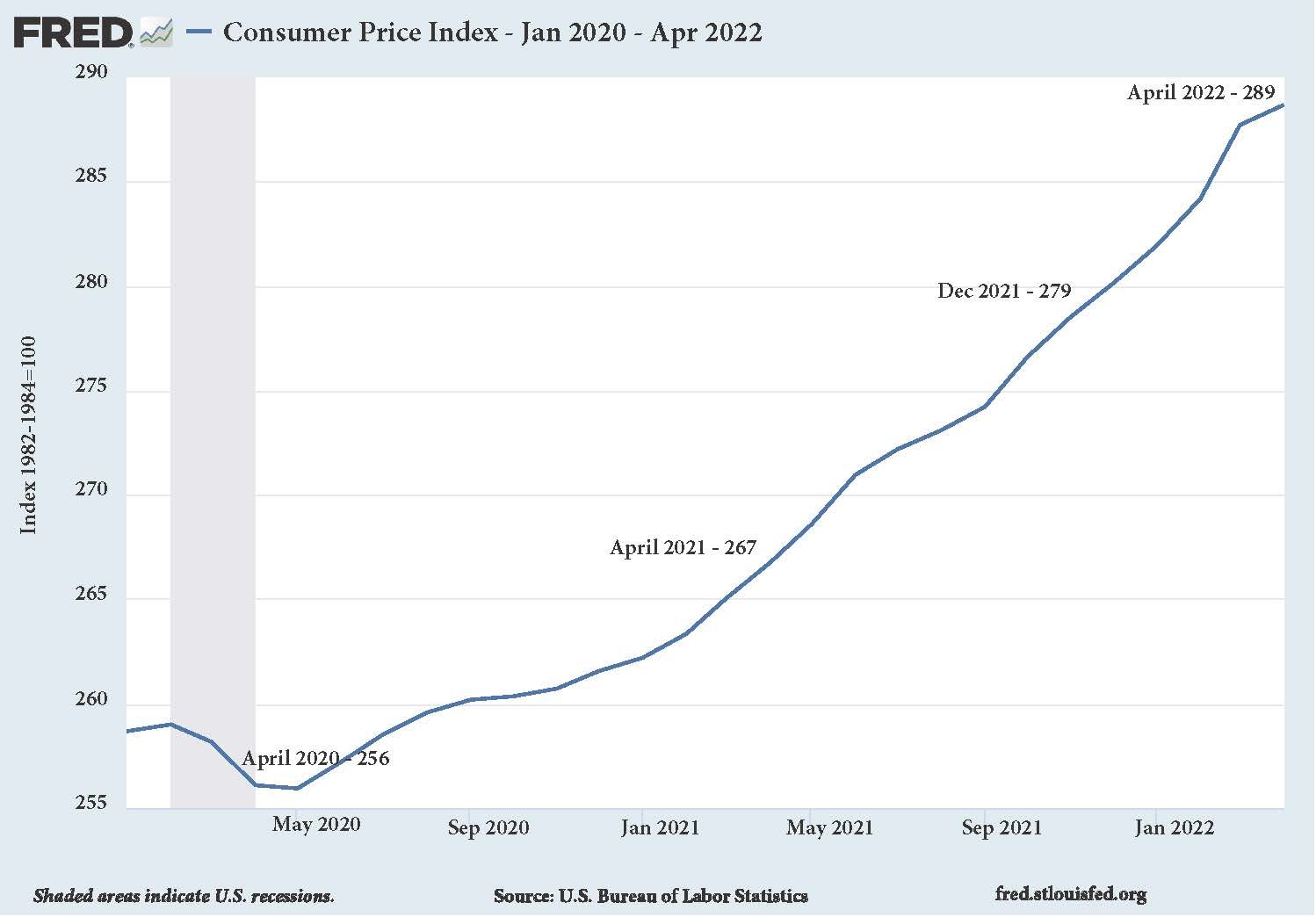

Fed Chair Powell Asked for Inflation and Now He Owns It

May 30, 2022 – In March 2020, Federal Reserve Chairman Jerome Powell (Fed Chair Powell) was concerned that Inflation was not hitting the target of 2%, but falling further. Well, his wish finally came true. Inflation in April 2022 was at 8.3% (Fig.1), the highest in the last 40 years and well above the Fed’s target. However, the Federal Reserve with J. Powell as its chairman, continued to print money and kept interest rates (Fed Funds) to almost zero. The Federal Reserve (Fed) serves as the central bank of the United States and is an independent government agency. For over a year, some Economists have been saying that the Fed is behind the curve, implying that it has been late in raising interest rates to curb inflation.

The Federal Reserve (Fed) is following the same playbook as other political entities in Washington DC. The playbook is very simple: First, to deny that there is a crisis, then acknowledge its existence once it is obvious. This follows up with the narrative that the crisis is temporary and everything is under control. Finally, there is the reaction to fix the crisis once it becomes acute and there is no way of denying its severity. Reaction starts slowly, drip by drip, hoping that the crisis will be contained. When it is too late to control the crisis then they react aggressively and take a victory lap once it is contained. (more…)