Excerpts from Confessions of an Old Man

“Washington borrows at 2 percent and charges students 7 percent in interest”

“Washington borrows at 2 percent and charges students 7 percent in interest”

February 22, 2020 – The federal government has been profiting from student debt earning $66 billion on loans originated from 2007 to 2012, according to Senator Elizabeth Warren. The profits could be as high as $185 billion on new student loans made over the next ten years. According to the US Department of Education, the federal government charged interest rates from 4.45 to 7 percent on student loans in fiscal year 2017–18. At the same time, SoFi, a private company, offers student loans as low as 3.25 percent. The federal government uses a ten-year bond issued by the US Treasury as a benchmark for its cost, which was about 2.4 percent in 2017. It appears that Uncle Sam is even worse than the Wall Street banks when it comes to making profits from student loans.

To help students attend college, Congress passed the Higher Education Act of 1965. It guaranteed student loans against defaults, promised certain interest rates to the banks, and paid fees to banks for the administration and collection of student loans. Later on, the federal government decided to provide student loans directly instead of going through financial institutions. The Direct Loan (DL) Program began its operation in the academic year 1994–95. Under this program, the federal government provides the capital and loan servicing, and the loans are originated by colleges and universities. By July 2010, the program accounted for 100 percent of new student loans—a government-controlled student loan program. One of the shortcomings of student loans through the federal government is having virtually no option to refinance the high interest rates. This option has been commonly available for other types of loans in the private sector but not for student loans from the government. Lowering student loan rates to match the cost to the federal government could put its profits into students’ pockets and help grow the economy. (more…)

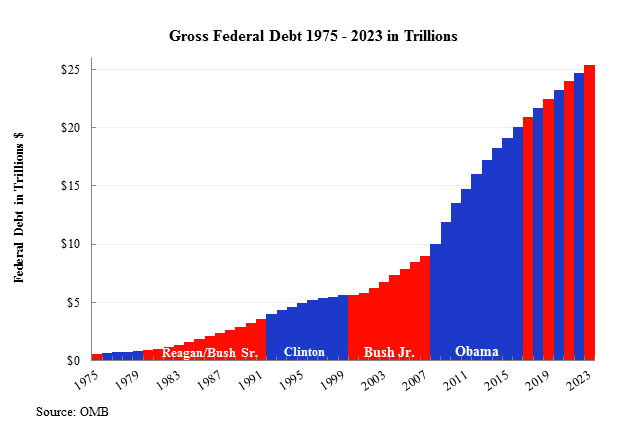

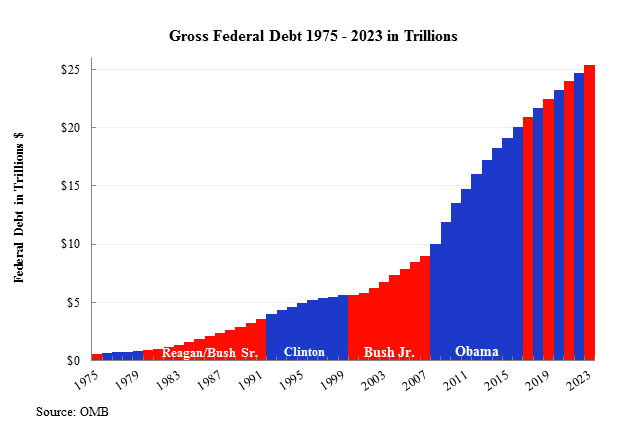

We are witnessing a grand, inter-generational Ponzi scheme that’s destined to drown our children and grandchildren in red ink. Our leaders like to call their strategy borrowing, but it is really tantamount to stealing—from our children, worse yet. Why? Because we have no plans to pay the debt. The real irony is that while civilian leaders from both parties insist that our national debt is not an immediate problem, a military man, former chairman of the Joint Chiefs of Staff Admiral Mike Mullen, has made the point that the debt is actually a national security threat. In a speech to business executives in September 2011, Mullen declared, “I’ve said many times that I believe the single, biggest threat to our national security is our debt.”

The Beltway Beast continues to borrow just to make interest payments that are estimated to be $5 trillion over the next decade. All the while we are doing nothing to pay down the staggering U.S. debt that is projected to reach $25 trillion by 2020 according to the Federal Budget Outlook of 2013 and 2014. Add to that $1 trillion in student loans and the result is a significant amount of money taken out of the economy that could be invested in creating jobs at home.

Equally alarming, perhaps even surreal, is that party leaders who can hardly agree on the color of the White House can be found nodding their approval at the fiscal fiction “that deficits don’t matter,” as then-Vice President Dick Cheney told a disbelieving Paul O’Neill, the treasury secretary in George W. Bush’s first term. That was over 10 years ago. Fast forward to President Obama, who told George Stephanopoulos in March 2013 that “we don’t have an immediate crisis in terms of debt. In fact, for the next 10 years, it’s [the deficit] gonna be in a sustainable place.” House Speaker John Boehner agrees that there is no immediate debt crisis. Neither one of them want to tell us who will pay the mounting U.S. debt.

Our handling of the national debt is like a grand, inter-generational Ponzi scheme that’s destined to drown our children and grandchildren in red ink. Our leaders like to call their strategy borrowing, but it is really tantamount to stealing — from our children, worse yet. Why? Because we have no plans to pay the debt. None. We continue to borrow just to make interest payments that are estimated to be $5 trillion over the next decade while doing nothing to pay down a staggering debt of $17 trillion.

Equally alarming, perhaps even surreal, is that party leaders who can hardly agree on the color of the White House can be found nodding their approval at the fiscal fiction “that deficits don’t matter,” as then-Vice President Dick Cheney told a disbelieving Paul O’Neill, the treasury secretary at the time.

Fast forward a decade to President Obama, the anti-Cheney, who was telling George Stephanopoulos on ABC that “we don’t have an immediate crisis in terms of debt. In fact, for the next 10 years, it’s gonna be in a sustainable place.” House Speaker John Boehner, considering the President’s comments in a separate ABC interview, concurred that the crisis is not immediate. This pervasive Washington attitude is reflected in Office of Management and Budget’s 2014 projections that show the national debt haplessly climbing skyward through 2020 with no sign of coming down.

(more…)

“Washington borrows at 2 percent and charges students 7 percent in interest”

“Washington borrows at 2 percent and charges students 7 percent in interest”