“The upper class keeps all of the money, pays none of the taxes. The middle class pays all of the taxes, does all of the work.” Late Comedian George Carlin

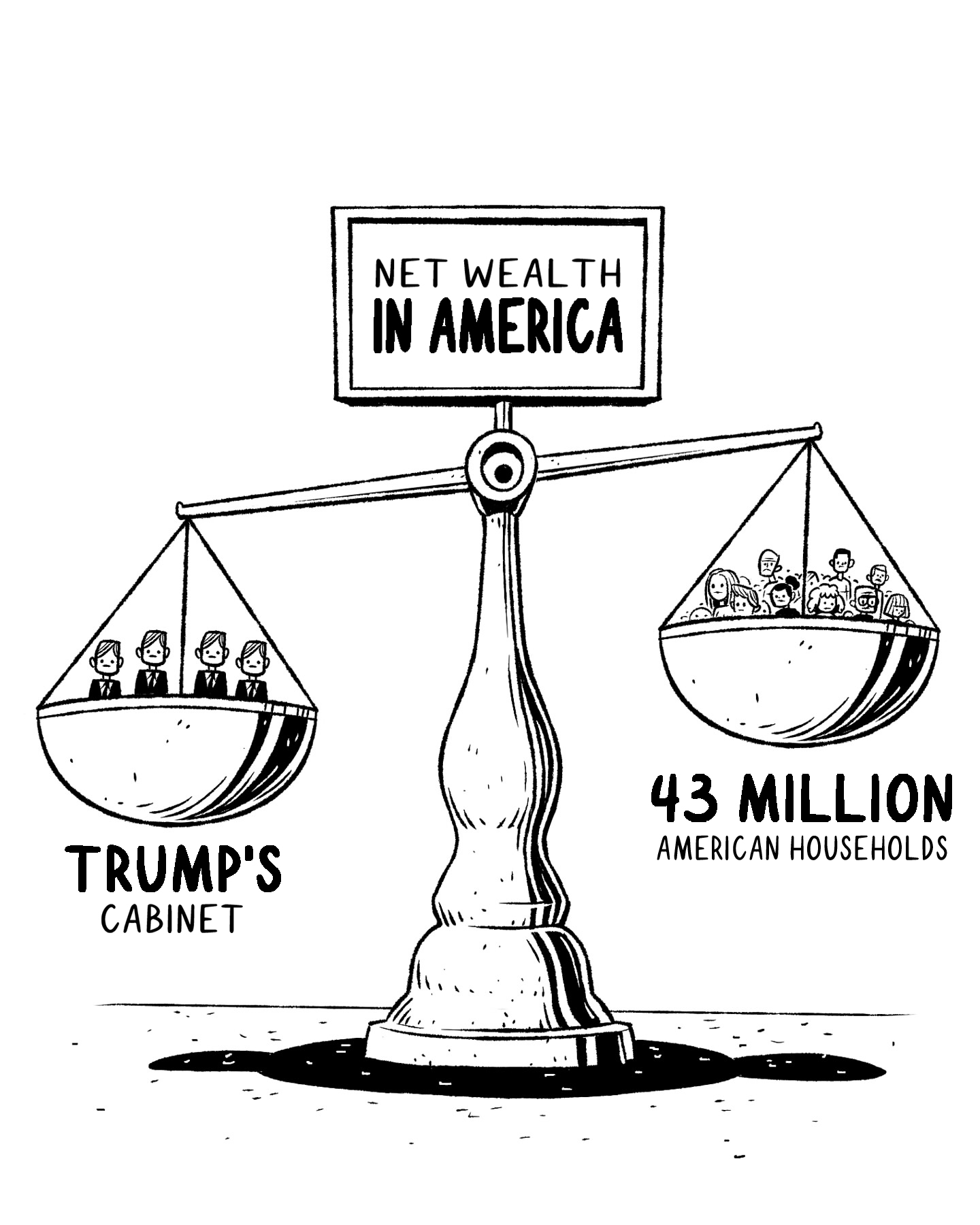

August 29, 2020 – President Trump, who is a billionaire, presides over the richest cabinet in US history. The combined net worth of the cabinet is estimated to be $9.5 billion or more. Another way of looking at it is that this cabinet of about twenty-five people is worth more than forty-three million, or one-third, of American households combined. It appears as if socialism is camouflaged as capitalism, whereby the US government is centrally controlled by a few. One can argue that the US government has turned from a government of the people, by the people, and for the people into a government of one percenters, by one percenters, and for one percenters. More than 50 percent of senators, 30 percent of congresspersons, and 75 percent of Supreme Court judges are millionaires. This does not mean that all rich people are bad or do not care about the country. The reality is that Americans face inequality everywhere, whether it is in wealth and income, gender, race, education, or even representation in government.

Wealth and income inequality have been more pronounced during the last three decades. The federal tax code is one of the key factors responsible for the rise in income and wealth inequality. Republicans believe in the top-down or trickle-down approach of providing tax breaks to the top one percenters and corporations—one of the ways to distribute money up from the middle class and the MI generation. They believe that it will spur economic growth because the more money corporations have, the more they will invest. More investments will mean more factories and more jobs. This is despite the fact that for-profit corporations are interested in making money, and they cannot make money if there is no demand for their products .

Historically, if you make money with money (i.e., investing in the stock market), then you are taxed at a lower rate than someone who earns money by working. This is one of the major impediments to the lower-income and middle classes building wealth. As billionaire Warren Buffett said, back in 2011:

“If you make money with money, you get taxed very—at very low rates; 15 percent dividends in capital gains. No payroll tax. If you make money with muscle or hard work or sweat of your brow, you get taxed at rates that move on up . . . then they get really hit hard on the payroll tax and that’s what brings the rates in our office up to an average of 36 percent.” [The 15 percent rate on capital gains has been increased to 20 percent since the time of this quote.]

The bottom line is that both major parties are responsible for income inequality, which results in wealth inequality. The middle class and the younger generation do not have enough income after tax to invest and build wealth. The simple reason is that income gains for the bottom 40 percent of households, from 1980 to 2013, have been under 46 percent, whereas this figure is 192 percent for the top one percenters. Both parties governed during that time, so neither one can escape the responsibility for such an outcome.

Gender inequality is pervasive, whether it is in the field of education, health, entertainment, or even government. Women are still fighting for equal pay and health research funding, as well as against sexual harassment. Heck, women can’t even get their pictures on US paper currency. The last time a woman appeared on paper currency was Martha Washington back in 1886. According to a World Economic Forum report, the United States is ranked 49th out of 144 countries, even behind Bangladesh, when it comes to gender equality. The report examines gender imbalances in economics, the workplace, education, politics, and health.

Racial inequality is pervasive and disturbing in twenty-first-century America. An average African American man earns seventy cents against a dollar of the hourly wage for an average white male worker. According to the Federal Reserve Bank of San Francisco, the unemployment rate for African American workers is 6 percent higher than that of white workers. With that backdrop, it is not difficult to see why African Americans cannot get ahead. The challenges to systemic racism have manifested in various forms, such as the Black Lives Matter (BLM) and “Take a Knee” antiracism protests. The BLM protests are a response to the violence and systemic racism toward black people who are discriminated against because of their color.

The White House and Congress reflect a stark contrast to the American population in terms of equal representation. Women comprise only about 20 percent of the House and Senate, even though they make up 50 percent of the population. Only 5 percent of them are Republicans in either the House or the Senate. Ninety percent of senators are white, and the other 10 percent includes only three African Americans, four Latinos, and three Asian Americans. Only four minority women senators are represented in the 115th Senate. The average age of a congressperson is 57.8 years and that of a senator is 61.8 years. There is no voice for the MI generation. None of these inequalities can be addressed unless we have a government that represents all Americans. Therefore, it is vital for the MI generation to get engaged, or else they will end up paying for all the excesses of my generation, including health-care costs.

So the basic question worth pondering is this:

“Why is working income taxed at a higher rate than nonworking income?”